The Indian paint industry exhibits an oligopolistic structure, with the top five players (Asian Paints, Berger Paints, Kansai Nerolac Paints, Akzo Nobel, and Indigo Paints) dominating approximately 90% of the organized market, estimated at Rs 62,000 crore as of the end of FY23.

Asian Paint FY24Q3 - economy and the premium segments are very big segments as compared to just the luxury segment. And therefore, from a point of view of overall growth, when you grow in some of these areas the gap tends to be.

Indigo FY23Q4 far as the premium end of the paints are concerned, the market share of the market leader would be disproportionately high as far as that segment is concerned.

The industry boasts formidable entry barriers for newcomers, as existing players have established robust marketing and distribution networks, as well as a strong brand presence. Nonetheless, long-term competitive intensity is poised to escalate with the entry of new players such as Grasim Industries, Pidilite, and JSW Paints. These financially sturdy entrants are anticipated to disrupt the market over the long haul.

Grasim: Birla Opus entered the market with the aspiration to be the number 2 player in the decorative segment.

JSW Paints was incorporated in February 2016 and expects to cross ₹2000 crore in revenue in FY24.

Astral Paints (acquire Gem Paints Private Limited (GPPL)) will manufacture a wide range of paints from a state-of-the-art manufacturing facility at Nelamangala (Karnataka) with an Annual Capacity of 36,000 K.L.

Pidilite Industries (PIL), renowned for its adhesives and home improvement sectors, is venturing into the decorative paints market with the debut of Haisha Paints.

Over the next three to four years, the industry is expected to augment its capacity by 20% of the current levels. This expansion will intensify competition, exerting pressure on the margins of top players.

Mold-Tek Packaging FY24Q3 - We are very positive that the stagnation or drop-down in Paint numbers would be reversed definitely from Q1FY25. Aditya Birla Group (Grasim) order start flowing should add 10% to the overall paint segment.

Dealers are the backbone of the Indian paint industry, acting as the crucial link between paint manufacturers and consumers. Paint dealers have low margins so dealers will only stock a product that turns quickly else he doesn’t make their ROI.

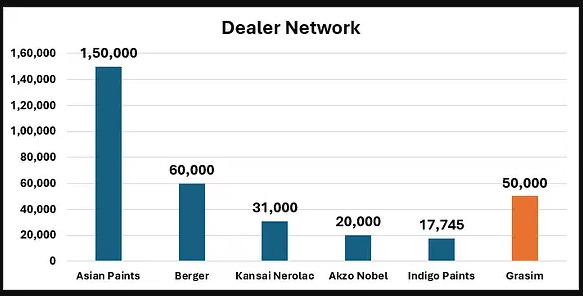

Over the years all companies have built a formidable network of dealers as follows.

In terms of distribution and market outreach, the top five industry players possess a substantial dealer network spanning the entire country. Achieving parity with them in this regard will demand substantial time and investment from the new entrants.

Incumbents Option gain market share

[Higher discounts] Better incentive for the dealers which will impact the margin but will attract the dealers. a player like Nippon Paints does. which hurts the profitability of a new player for a new player for very long.

[Marketing] Players like JSW Paints already spending ~15% of revenue much higher than the established players who are spending in the range of 5%.

[Product]Differentiated product to customer in its niche sub-segments. Indigo Paints has made a mark by focusing on niche products and strategic geographical expansion.

[Low price] Industry no one prices products at big premium to make super-normal margins so that someone else can enter. Incumbents have to provide lower prices which impacts its margin. Birla Opus planned to provide more quantity in each box.

Incumbents Challenges

[Build last mile distribution] Paint is a highly voluminous product with low realizations per unit volume which is sold directly to households from space-constrained paint shops. Paint company has to build formidable distribution to reach customers. Incumbents have to spend money considerable time to gain market share to attain the economy of scale.

[Ability to sell high-margin products] The volume of sales is majorly in the economy and the premium segments as compared to just the luxury segment. Catering to high volume is highly cost-optimized play and luxury is long-term brand game.

[Find dealers who can sell] Dealers are the backbone of the Indian paint industry, acting as the crucial link between paint manufacturers and consumers. Paint dealers generate a healthy ROI through rapid inventory turns, if they sell more, they get more income.

Summary

The Indian paint industry exhibits an oligopolistic structure, with the top five players (Asian Paints, Berger Paints, Kansai Nerolac Paints, Akzo Nobel, and Indigo Paints) dominating approximately 90% of the organized market, estimated at Rs 62,000 crore as of the end of FY23.

Pidilite FY24Q3 There are enough gorillas trying to fight it out. We are not looking to enter the ring and fight amongst the gorillas.

Long-term competitive intensity is poised to escalate with the entry of new players such as Grasim Industries, Pidilite(expanding its economy segment), and JSW Paints. These financially sturdy entrants are anticipated to disrupt the market over the long haul.

JSW Paint uses slow expansion as its strategy, Indigo Paint expanding in mid and economy segments one region specific and making good growth in volume. The big media support for Grasim I believe its capital commitment is quite high compared to any new player which is what matters to establish themself over say 5 -8 years. Will Grasim win with money which will not be easy as it is very evident from JSW Paint which started sometime in 2016 still decorative segment is not profitable which speaks for itself about the challenge in the market.

Indigo FY24Q3 we would not expect a conservative solid player like Grasim to come up with anything irrational.

The industry participants are familiar with the competition; they have faced it all while growing their businesses. The established player enjoys a dominant distribution network, a well-managed sales team, and the support of its large dealer and painter's network.

Competition is real I could not find any other explanation for why established players are increasing discounts and rebates. My take is this could be just an approach to keep the dealers that can sell on their side and not let them go with competition for a shorter margin.

For the time the margin would be tight, and this will lead to the consolidation or some insufficient pliers vanishing from the system. Till then it would be a bit negative as they would not have great growth with margin.

The way I see there could be some consolidation in the paint industry as big players dominate the industry which is evident from Mold-Tek Packaging to focus on big players over the smaller players.

The way I see Asian paint or Berger what matters is its luxury dominance which gives them a better margin till they hold on to it others would find it hard to make a dent in the long term.