Hotel Industry Notes

Industry

The travel market in India is projected to reach USD125 Billion by 2027 from an estimated USD 75 Billion in FY20.

Global Industry View

Tourist arrivals internationally for 2022 were 917 million, double that of 2021 but recovering to 63% of pre-pandemic levels of 2019

Indian Industry View

The Indian hotel market including domestic inbound and outbound was estimated at USD 32 billion in FY20 and expected to reach USD 52 billion by 2027.

Foreign tourist arrivals were 6.19 million for the calendar year 2022 compared to 1.52 million in 2021. This constituted 57% of 2019 foreign tourist arrivals at 10.93 million.

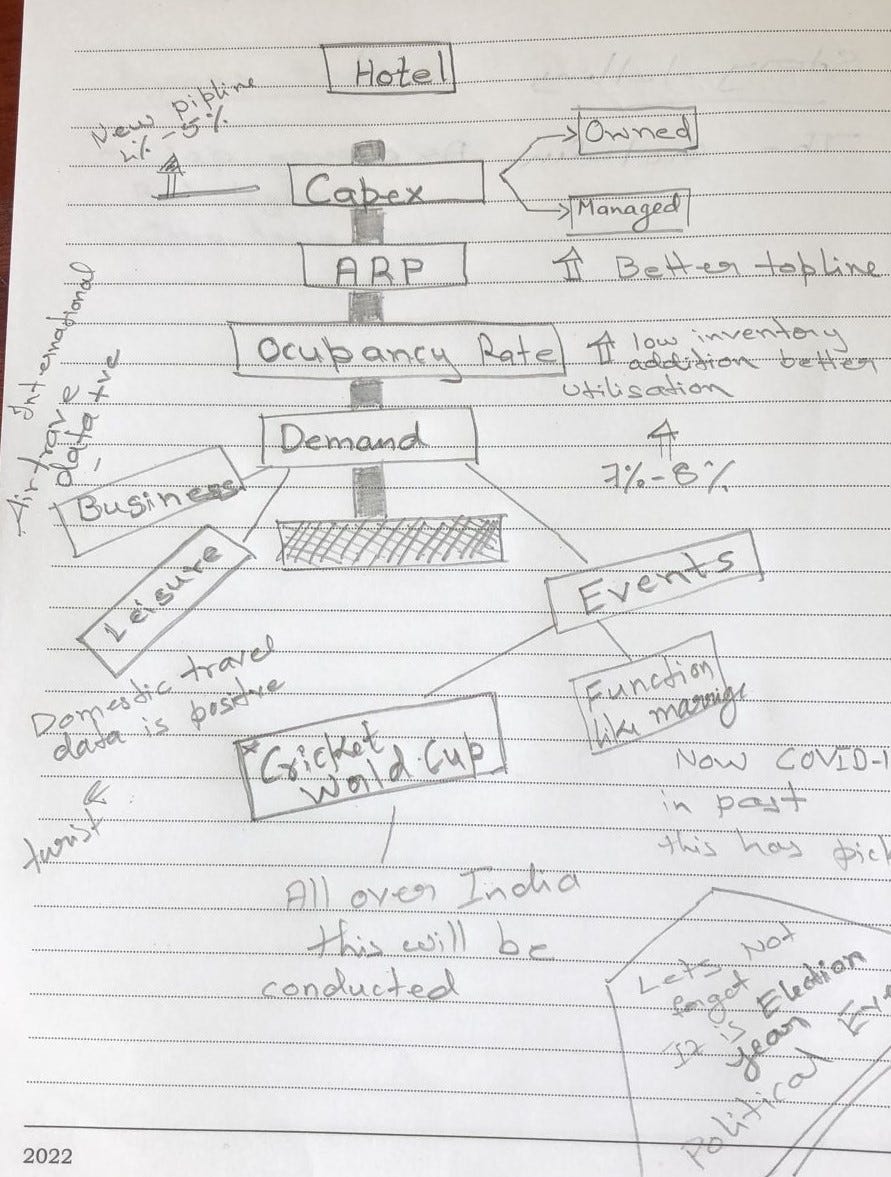

Demand

Demand for hotel rooms in India comes from both domestic and foreign tourists, for both business and leisure purposes. From a predominantly foreign tourist market, the Indian market over the past decade has slowly matured into a much larger domestic tourist market, with a higher incidence of leisure trips.

Leisure travel is purely discretionary and a function of disposable income and consumer confidence

Business travel is generally more stable but is prone to witnessing pruning by corporates during periods of downturn.

High penetration of low-cost airlines, more airports, improved road connectivity, and industrial activity also play a pivotal role in driving demand.

A few key Events and trends will support

G-20 Presidency: After two long years of absolute stalling, the G20 event has come as an excellent opportunity for the tourism and hospitality industry. The country is expected to host over 200 meetings at 56 locations

India hosting the upcoming Cricket World Cup in CY23, inbound tourism is expected to benefit

The government was working to increase the number of airports in the country to 200 by 2024 from the current 140.

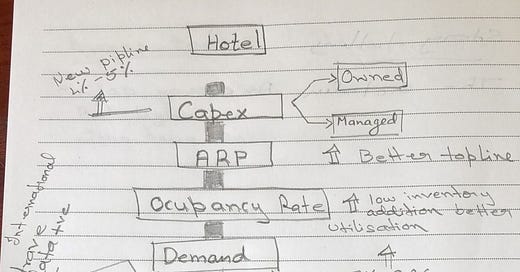

CAPEX/Supply

Supply of hotel rooms depends on the existing/under-construction inventory and estimated future potential for rooms stemming from either the economic or leisure potential of the destination. Surplus supply leads to lower pricing power, as more properties compete for the

available demand.

As of FY23, the supply addition is forecasted to be around 4 - 5% in the near time future with the expected demand for hotels to be growing at 7-8%.

Business models

Operating in a highly cyclical industry, hotels witness significant variations in profit margins through an economic cycle. Hotel revenues are highly cyclical, in view of the demand-driven price-elastic business model as well as the lumpy supply-side dynamics.

Owner-operator - An owner-operator model entails heavy investments by the owner in constructing the hotel and subsequently running it either under an owned brand or a soft branding arrangement with large global or Indian chains.

Franchisee - Under the franchisee model, the owner-operator enters into a brand franchisee agreement with established hotel chains for use of the latter’s brand name and the global distribution system (GDS), in return for a fixed franchise fee

Management Contracts - Under the management contract route, the ownership and management of the hotel is often independent. The owner invests funds to build the hotel and enters into a management contract with a major operator

Most of the top-listed players are trying to maintain owned inventory to be < 50% with the trend to move the owned capital-heavy real estate asset to be moved under a different company. Lemon Tree is even planning to list this entity separately to raise capital.

Sources of competitive advantages

A large scale is often a reflection of a strong market position, operating and financial flexibility, and staying power, and is also a driver of operational efficiency. It also determines the entity’s ability to withstand downcycle pressures. It is evaluated in relation to other peers in the hotel industry.

Operational track record – Stabilised properties could have advantages in the form of repeat customers while those with locational advantages will be able to generate higher ARRs

An entity with a presence across different locations which cover both business and leisure will be better diversified compared to those with hotels only in business or leisure destinations

Apart from the business models, larger hotel chains often operate across various segments: Luxury, Upscale, Upper-Upscale, Midscale, and Economy1. This segment diversification helps capture a wider traveler base and any down-trading in traffic during economic downturns, thereby helping the entities to maintain occupancies.

Brand strength –

An established brand, on the other hand, ensures visibility among travelers – both domestic and foreign.

Tie-up with reputed brands provides hotels access to a wider set of customers and helps with occupancy.

Hotels under the umbrella of established brands have higher pricing power stemming from various factors including their service quality.

Global tie-ups

The RevPAR premium of a hotel is viewed as a proxy for its market position. For the various properties that comprise a hotel entity,

ARR and occupancy trends

property’s RevPAR premium compared to its competitive set

The market potential for increasing RevPAR is based on the upcoming supply and inherent demand potential of the location.

Diversification

Besides generating revenues from room nights, meetings, incentives, conferences and exhibitions (MICE) and banqueting and other allied services add to industry revenues

Guest profile mix (foreign, domestic, business, leisure, walk-ins, FITs (free and independent traveler), airline crews, and government business) to determine concentration on a particular set of guests.

mixed-use properties that earn revenues not only from the hotel but also from leased-out commercial space, office space, and residences are often viewed favorably as they diversify the revenue base and are relatively stable earnings-wise compared to hotels.

Conclusion

With the present post COIVID-19 situation hotel industry is having good optimism in demand and much inventory addition in the pipeline. Companies in the industry expected to have better occupancy and ARR for the inventory which is clearly visible in the future plan for most of the listed companies. Industry seeing good attraction in managed contracts and expansion to the smaller city too.