The Byke Hospitality Ltd

The Byke Hospitality Limited is a hospitality brand addressing India’s midmarket segment. The Company has 15 properties with 2 owned and 13 leased combined they have 1031 keys. The Company’s restaurants and banquets serve only vegetarian food.

Owned & Leased Business:

The Company generally manages properties around long-term operating leases (10-20 years). The refurbishment and rebranding is completed during the rent-free period of 3-6 months followed by a focus on better management, marketing, and distribution capabilities across room sales and F&B / event revenues.

Room Chartering Business:

The Company aggregates third-party rooms at popular tourist and religious destinations across India during peak seasons and markets them at a higher tariff through a pan-India network of more than 300 agents. This business segment makes it possible for the Company to comprehend traveler footfalls across various destinations, resulting in a deep bottom-up understanding of the business across the country. This knowledge also empowers the Company’s Own and Lease business to extend to new locations with potential based on existing tourist flows.

As of FY19 company faced loss after intense competition in price and demand they are not talking about this segment in the recent Annual report

After carefully reviewing business viability, the chartering aspect of the business continue to see significant competitive pressure in terms of pricing and also volume within local geographies, so clearly making exit at the right time is one of the most vital decisions. The Company encountered unfortunate losses in its chartering business due to unsold inventories, which was a setback. However, it was an important lesson learned which led us to now focus on the growth of our own brand value. So clearly Byke as a brand is continuing to be in a state of evolution as in the industry and as a business.

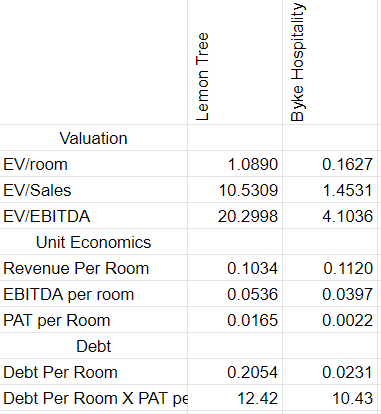

To study further compared it with Lemon Tree, the numbers are as below.

Valuation looks cheap, and unit economics very close to Lemon Tree with the only big concern was PAT per Room is very low.

Let's explore the following

Why PAT per room is low is it historically at this level or changed over time?

Do they have an untapped capacity to bring in growth in the bottom line?

Historical Snapshot for the last 10 years

Few findings

The company had better PAT per room till FY17. Based on the past Annual report data company used to have another segment “Room Chartering” in which the company only acted as an aggregator and this used to be 50% of its revenue in FY17. What changed

Account standard changed so in FY18 as per the new approach the revenue from Room Chartering is 21%.

In FY19 company underwent to lose in Room Chartering due to market and pricing challenges - they could not clear the inventory.

The company operates in a midmarket segment which is extremely sensitive to price.

The company decided to enter the Management consulting segment which has not made any meaning full progress for the last 5 years.

Study of current property they operate

Upon analyzing the social data related to their property operations, it becomes apparent that complaints exist, although they are consistent with those encountered by other competitors within the same category. Evidently, the customer base that engages with their services prioritizes affordability, and it's noteworthy that other similar establishments in the vicinity also offer services within the same category. Competition is intense.

From my perspective, improving its Profit After Tax (PAT) per room is key. This is crucial because the company requires a higher PAT to effectively maintain its properties and manage the existing mounting debt per room. Unfortunately, the discontinuation of the Room Chartering Business segment has negatively impacted the company's overall financial performance. Additionally, while there were expectations that management contracts would compensate for this loss, significant progress in that direction has yet to be realized.