Zaggle was launched in 2011 to build state of the art financial solutions workflow and products which would help automate and empower businesses to increase efficiency, accuracy, transparency, and productivity. The company works with corporations as its interface or client and services to users who are employed or vendors to the cooperate client of the Zaggle.

The company has one of the largest numbers of issued prepaid cards in India in partnership with certain banking partners (which constituted approximately 16.0% of India’s total prepaid transaction volume

Partner

Zaggle firmly believes in collaborating with a strong player in the ecosystem, so it drives most of the sales through the Partnership.

The company has bank partners like ICICI Bank, Kotak, SBI card, IndusInd, Bank of Baroda, Yes Bank, DBS Bank, and NSDL Payments Bank. As network partners the company works with Visa, RuPay, and MasterCard. The company undergoes case specific Partnerships some are listed below.

Kotak Bank bundling Zaggle to serve its salaried accounts.

Through this strategic partnership, Zaggle will provide bundled services of Kotak Bank corporate salary accounts plus employee flexi benefits, and disbursal on a co-branded prepaid card for employees of corporates. This will make the Zaggle service site with the Kotak cooperate salaried workflow.

In this partnership, the Bank will bear the cost of the software fees for expense management and employee benefits. If the employees are taking a Kotak Mahindra Bank best-in-class salary account, the software platform would come free of cost for corporate.

Kotak Mahindra Bank, there where the VISA fees, the RuPay fees are taken by the bank, the switch costs are taken by the bank. There it's 80% Zaggle, 20% banks sharing.

Torrent Gas - fleet loyalty card

Zaggle by working with Torrent Gas made entry into the fleet loyalty card program. As per the company, the total fleet spends market is estimated to be about Rs.73000 Crores in India which they want to enter with this partnership. Torrent Gas is ultimately benefiting in terms of sales, so they pay us a percentage of the spends that they get or a percentage of business that they get.

Fleet owners struggle today with managing their cash because they need to pay the drivers upfront for a trip that could be 30 days. Putting this money onto a prepaid card giving it to the driver and loading this money on a periodic basis and daily basis helps fleet owners manage their cash flow much better and gets partners like Torrent Gas and others assured sales,

It is a prepaid closed-loop program. We work with partners like Torrent Gas and these cards would be issued to fleet owners, fleet owners would in turn pass it on to the drivers, as of now 500 fleets are onboarded and 260 outlets are ready to accept our cards to start with.

Travel booking partnership

The company also partnered with Ease My Trip and Riya Travels wherein Zaggle would be integrating their travel solutions with our expense management solutions for our corporate clients.

Product

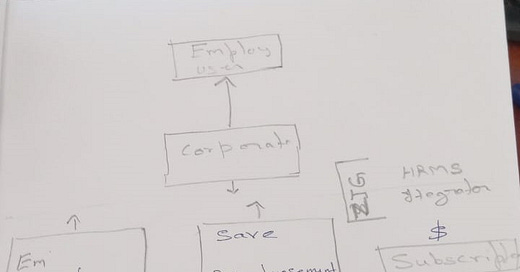

The company builds SaaS solutions for its clients to manage different use cases and sell inventory of money cards and Vouchers. To work effectively Zaggle has built Zaggle integration platform which is called ZIG which has integrated with most major ERP providers. The company intends to have integrations with relevant ERPs, HRMSs, accounting, and various other software packages to make service essays to use by its clients.

When a corporate today signs up with Zaggle, we offer them two solutions which are 1. employee expense management, and reimbursements and 2. reward and employee benefits platform.

Expense Management

With this effectively, corporates can digitize their employee expenses and expense tax benefits, as well as their reimbursements on a single payment instrument that can replace food coupons, food cards, fuel cards, travel vouchers, gift cards and any other payment instrument that a corporate gives for employees to incur these expenses.

Products

Save which is for expense management, employee reimbursements, etcetera.

Zoyer integrated data-driven business spends management platform with embedded automated finance capabilities and is tightly coupled with our corporate credit card products to facilitate vendor payments

The company traditionally used to work with prepaid cards for the reimbursement process but now it has launched a corporate credit card where the employee can go ahead and directly spend through a corporate credit card issued by Zaggle and a partner bank. And in such a case, all the bills are scanned on the platform for records and the company goes ahead and clears the credit card bills.

Once the platform is integrated with the internal ERP system it could help corporate to manage the budget from the project and manage expenses at the project level.

Zaggle serves the biggest food delivery companies in the country. A lot of them are the delivery boys. So, this is not just your white-collared, sophisticated employees on the company base, but it could be a blue-collared worker as well, a third-party payroll.

Employee Reward

Employee rewards and recognition, allow corporate customers to increase their engagement. Their employees basically get reward points for performance linked, which could be festive occasions like Diwali, or New Year. So, they could use the platform to reward their employees for a variety of reasons.

These points are then redeemed for vouchers of over 300 brands, brands as Amazon, Shopper Stop, Tata CLiQ etcetera. And we get paid by corporate for the points that get redeemed. Traditionally HR does bring in local merchants to provide products for its rewards. This platform brings in a large pool of merchant options which employees could choose from based on what they have earned as points in the system.

Products

Propel platform, which is for channel rewards and incentives, to corporate employees.

Zaggle has API integrations with partners, including merchants, and other third-party providers where it gets these vouchers in real time. So, from a voucher inventory perspective, only for very smaller brands we may have a small amount of inventory. But for the larger brands, we tend to be able to pull the vouchers in real time.

Corporates manage the tax part of it because they are aware of what the income structure, the salary structure of the employees so the corporate in any case just like does a TDS for any of their payouts, the corporate takes a call for this payout whether it is for employee or channel, what is the applicable TDS.

The company traditionally used to provide gift vouchers for the Propel points, now they are moving away buy more gift cards (network cards) which gives us a much higher gross margin profile. Propel does not have a Visa in this that is more with the merchants like Amazon.

Companies like Sodexo charge 4-7% service/commission charge to merchants on its coupes or card which puts up a question of how much more take rate companies can get from selling gift cards of other companies.

Revenue model

Zaggle earns through software as well as you know that transaction income. In the software it earns a per user per month fee as well as per invoice fee for the platform and on the card, it earns the percentage of transaction value.

When the vouchers are given to the employee, Zaggle earns commissions from its merchant partners. So, let's say a Shopper Stop voucher is given to an employee because he has chosen to redeem for shopper stock vouchers. It has a healthy take rate there of about 10% to 15%.

The company wants to focus on our program fees and Saas fees because, on the program fees, our gross margins are at about 95% to 96%.

The company reports the following 3 income streams in its reporting.

Platform fee

Platform fee / SaaS fee / Service fee refers to all fee income received by our Company from the Customers, including the fixed monthly subscription fees paid by our customers on a per User basis and any one-time setup fees and any other fees that may be levied from time to time by our Company to the Customers. It is basically the subscription fee Zaggle charges its clients.

Program fee

This is the income that we earn percentage of transaction value that happens on its prepaid cards or credit cards. This is a combination of income that we earn through partner banks, through networks, and any other smaller fees etcetera that we levy.

It invoices banks and partner networks, and it gets paid by these entities. They in turn get it from the network itself. There is always a risk of interchange fees charged on the pre-paid cards with this in mind company has focused on co-branded corporate credit cards which is expected to be healthier for the company.

Propel platform revenue

Propel platform revenue/gift cards refer to revenue that is generated by providing vouchers for reward points (Propel points). This part of the revenue is reported on a gross basis.

Major Risks

Number of Transactions

Card-based retail transaction volume is expected to remain lower than other payment-type transactions as consumers shift to UPI payment modes. However, volume is expected to increase as more prepaid cards are used.

Incentives and cash back

The company spends a considerable amount to buy sales(topline) basically company uses this as a nudge factor for people to use. There is a greater risk that people may not use the products if the incentive is reduced.

Conclusion

The company offers a software platform that integrates with customers and vendors, streamlining the management of expense and gift workflows. There is no specialization other than integration and partnering with existing players to make its product available to a larger number of people.

Particularly as more and more transactions are moving digital, people are conscious of how much they pay per transaction as India has UPI. Zaggle depends on the take rate of the card transaction and a small subscription fee for its software usage. It will be interesting to watch how they going to build deeper value, so they command better take rate in digital transactions.

As of now the growth of revenue per customer or user level is not attractive. The future company growth is purely dependent on the corporate addition and cross-selling of its use case to increase revenue.

I would wait for the company to build deeper working on inventory provider or at the consumer end with more clear value addition to be a serious fintech player.

Hi Girish, nice write up and thanks for posting. Was going through the Annual report after reading this. Two questions - in their BS, they have large receivables outstanding and there is something called as Prepaid Card loading. These together are essentially why it is not generating enough Fcf. Any idea what this Prepaid Card loading (recognized as asset) is and the reason for large receivables? Apart form that business wise, Zaggle does solve a problem that corporates have and plus there would be switching costs involved once it is completely integrated into their system. So the levers for growth are there. So i did not quite understand, what you mean by "I would wait for the company to build deeper working on inventory provider or at the consumer end with more clear value addition to be a serious fintech player." - Could you please elaborate?